Donor-advised Funds: Flexible Philanthropy Provides Benefits in an Ever-Changing World

2018 saw the biggest change to US tax law in more than three decades. Those changes have many individuals reevaluating how they make charitable gifts to the institutions they value and support. The Episcopal Church Foundation (ECF) helps provide support to donors and their philanthropic work through the administration of its donor-advised fund (DAF) program.

The Tax Cuts and Jobs Act of 2017 included a sharp increase on the standard deduction, decreasing the need or benefit of itemizing deductions for many taxpayers. As a result, many experts believe donors may choose to “bunch” their donations by making major gifts in select years to exceed the standard deduction.

Charitable giving tools like donor-advised funds can be useful to donors who want to reap the tax benefits of immediate charitable giving, while maintaining the flexibility of giving smaller gifts over a period of time. That flexibility makes “bunching” donations much simpler.

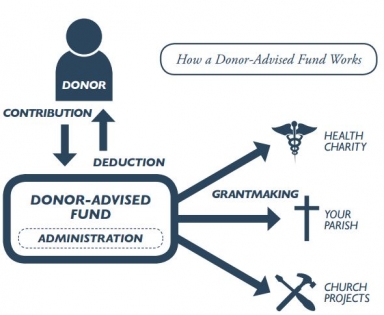

Donor-advised funds function like a charitable checking account. A donor makes an irrevocable gift to establish the donor-advised fund and receives a charitable deduction in the full amount of their contribution. A donor-advised fund with ECF can be established with as little as $2,500. With oversight from the sponsoring charity, the gift is then invested in an investment strategy of the donor’s choosing, allowing for potential growth of the principal value of the gift depending on market performance.

Once the fund has been established, the donor advises on the distribution of grants from the fund. Grants can be made to any qualifying charitable organization in any frequency and amount upward of $100. Recurring grants can also be established and, should they choose, donors can make grants anonymously.

By utilizing a donor-advised fund, donors can take advantage of the benefits of donation bunching while retaining the flexibility of making smaller gifts to charitable organizations over a number of years. Beyond income tax advantages, DAFs can provide other significant tax advantages, as well:

- Donations of appreciated assets such as stocks or mutual funds incur no capital gains tax when gifted to a donor-advised fund.

- Gifts to a donor-advised fund have the potential to appreciate tax-free.

- Donor-advised funds are not subject to estate taxes.

Donor-advised funds function similarly to a family foundation, without much of the administrative or regulatory burden. Donor-advised funds can also be a powerful tool for expressing a family’s core values and beliefs and can be used to pass on a philanthropic spirit from generation to generation. Donors may also elect to name a successor advisor to their DAF who would take over advisory responsibilities following the death of the fund’s advisor, paving the way for a lasting legacy of family philanthropy for generations.

In addition to simplifying current giving, ECF’s DAF provides a unique opportunity for planned giving, as well. Donors may choose to cement their legacy of giving for years to come by providing for the disposition of any balance remaining at the time of their death. The DAF balance may be transferred to charitable organizations of the donor’s choosing, or may be used to create a permanent endowment fund.

As one of the fastest growing means of philanthropic giving, DAFs provide the flexibility and simplicity many donors are seeking to achieve in a rapidly-changing landscape.

ECF is happy to speak with donors regarding their desire to establish a Donor-advised fund or other instrument of charitable giving. For more information on ECF’s donor-advised fund, please visit http://www.episcopalfoundation.org/programs/daf or contact us at 800-697-2858.

Donors are strongly urged to consult their own counsel and advisors about the risks and financial and tax consequences of any proposed gift.